If you’ve been waiting for the right time to make your home more comfortable and efficient – this is it.

Today’s Maine energy rebates and financing options are higher than they’ve ever been, making it easier for you to take control of your energy costs and improve your home.

At Evergreen, we’re here to guide you through the process step by step and help you claim every dollar you’re eligible for, including:

- Up to $8,000 in Efficiency Maine rebates

- Financing with payments as low as $50/month

Our commitment to helping you save is a core part of our DNA: The very first Mainers to receive Efficiency Maine rebates and financing worked with Evergreen, and we’ve helped more Maine households receive rebates than any other company in the state.

We’ve been doing this for nearly two decades – and we’ve never seen incentives this strong. There’s no telling how long this situation will last, so don’t leave money on the table – reach out to Evergreen today!

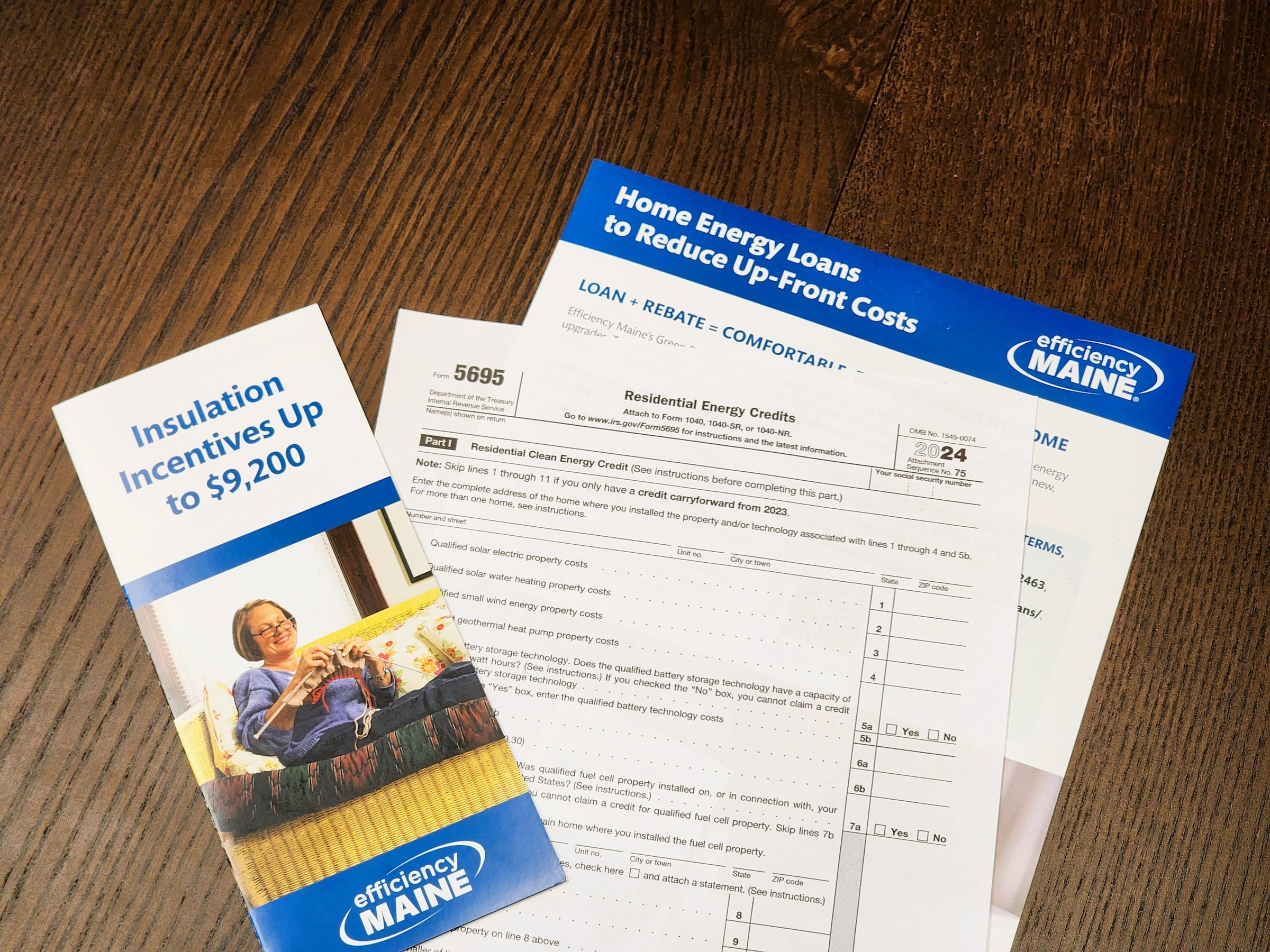

How to Combine Rebates and Loans

Stacking or combining available incentives is the best way to get the most value out of your home upgrades, and Evergreen helps make it possible.

Example:

Let’s say your project costs $10,000. From there:

- You qualify for $6,000 in Efficiency Maine rebates

- You finance the remaining $4,000 through Efficiency Maine’s Green Bank (just $44/month)

That’s thousands saved – putting you on the path to a more comfortable, efficient home.

Green Bank Financing

Green Bank Financing

Many homeowners choose to finance their upgrades and pay over time. We make that simple with multiple options including Efficiency Maine Green Bank Loans and National Energy Investment Fund EnergyPlus Loans. With monthly payments as low as $50 a month, financing your project with Evergreen can make improving your home truly affordable.